#72 France: Tougher Measures for Crypto Providers Ahead of MiCA. ERC-4337 Deployed - Opening the Door for Smart Accounts.

Disclaimer: Everything we write in "The Crypto Insider Report" is an x-ray of the industry as we see it, through the lens of publicly available information. We are not financial advisors.

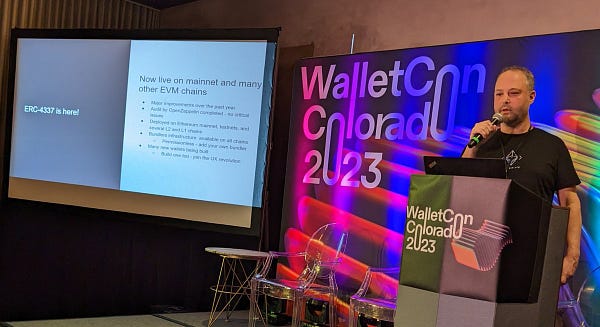

ERC-4337 Deployed - Opening the Door for Smart Accounts

One of the biggest issues hindering Crypto adoption is the complexity and responsibility that wallets come with. They are not necessarily beginner friendly and should you lose your seed phrase, you are out of luck - your funds are gone forever. That’s not the way to onboard the next billion users.

To help with this, Ethereum developers have been working on a new standard - ERC-4337 - allowing for what is called account abstraction. On the Ethereum blockchain, there are two types of accounts that can hold tokens - external owned accounts (aka regular wallets) and contract accounts (aka smart contracts). External owned accounts can initiate transactions - having access to the private key, a user can execute a transaction on the blockchain. Contracts, on the other hand, cannot - they have to be called by someone. Should the wallet owner lose access to their private key, they won’t be able to initiate any transactions anymore against the balance of their account. A smart contract, on the other hand, does not have this issue. It is always present on the blockchain and it can be programmed to allow transactions from multiple wallets and, why not, to support adding and removing authorized wallets. If you think about it, this is pretty much what a multisig does.

ERC-4337 is now live - allowing companies to build on top of it. One of the first to do so is Stackup, a company working on user-friendly wallets, doing away with concepts such as seed phrases and gas fees. Imagine having something as easy to use as Cash App or Revolut, but running on the blockchain. Pretty huge!

Mihnea

BUSD’s landslide

At the peak of BUSD’s marketcap, I wrote a piece on “CeFi’s stablecoin wars”. Right around that time, Binance announced that it will be converting most new stablecoin deposits into BUSD, thus greatly boosting its market cap. And all these happened without looming regulation above Binance’s head - the SEC wasn’t as harsh back then.

Now, however, we’ve encountered problems with stablecoins and the issuance of new BUSD tokens. As you might expect, this created a landslide effect for BUSD and for Binance’s image, although CZ’s tweets might not give you the same impression. Who would’ve known that among all the FUD around USDT, they’d be the ultimate winners:

Since then, BUSD’s marketcap fell ~40% and is essentially in free fall. Should this cause panic in the markets? Thing is, BUSD is most likely turning into USDT so probably not a major concern. But you can never be too careful, especially with centralized entities.

Interestingly enough, BUSD’s rally didn’t last long. CZ might own the largest exchange (in terms of traded volume) but this doesn’t mean he’ll win every battle. With MiCa being worked on and the US adopting a rather hostile attitude towards crypto, centralized stablecoin issuers should be on the lookout. Let’s see what DAI and FRAX have to say about this in the long term - although a lack of understanding about on-chain operations slows down the adoption of decentralized stablecoins

Matei

France Wants Tougher Measures for Crypto Providers Ahead of MiCA

The French National Assembly has voted to impose stricter licensing requirements on crypto service providers as the country aims to align national policy with proposed EU rules. The bill, which the French Senate has already approved, received 109 votes for and 71 against, according to an assembly broadcast.

The legislation will now go to President Emmanuel Macron, who has 15 days to approve it or send it back to the legislature. If signed into law, the new regulation would do away with the grace period that currently allows over 60 crypto platforms to operate in the country without a full license until 2026.

The new law would require companies to obtain a full license from the Autorité des Marchés Financiers (AMF) beginning in October instead. It forms part of a broader effort from French lawmakers efforts in what they deem as a means to protect the financial system after the collapse of FTX.

In contrast, the EU’s Markets in Crypto Assets (MiCA) bill includes a 12–18-month adaptation period and is set to take effect in full at the start of 2024 at the earliest.

The final vote from the EU parliament was deferred to April 2023, after being previously delayed from November 2022 to February 2023. Even though the adoption vote that is missing it’s just a formality we believe it’s likely that another delay will intervene. This is why nations such as France might want to urgent imposing stricter measures.

Evelyne

For more educational crypto content, check out the links below:

The Stakeborg DAO Talks on YouTube: https://www.youtube.com/playlist?list=PLOrFZZifNn4Nx4nSQL3WS52ALPXgrTSVG

Discord channel: https://discord.com/channels/901898461568442458/903006233584341052

StakeborgDAO Quarterly Reports: https://docs.stakeborgdao.com/reports/dao-quarterly-reports

Stakeborg Academy:

https://academy.stakeborg.com/

👍👷🏼♂️🧱