#33 The Metaverse Race is getting Richer. Blockchain- the solution for supply chain disruptions.

Disclaimer: Everything we write in "The Crypto Insider Report" is an x-ray of the industry as we see it, through the lens of publicly available information. We are not financial advisors.

Coinbase and Robinhood Make Web3 Moves

One of the main difficulties people have with Crypto is actually controlling their funds. Passphrases are complicated, the risk of losing them is scary and the fact that there is no customer support call center you can fall back to is unusual. Thus, a lot of users prefer to simply keep their portfolio on centralized exchanges and in neobank apps such as Revolut. “Not your keys, not your tokens” is a totally valid argument but when you have between being 100% responsible for what happens with your tokens vs relying on a 3rd party to take care of it for you, you choose the lesser evil.

Having assets on exchanges comes then with another issue - Web3 is where all the hot stuff is happening, and to access it, you need a non custodial wallet (think Metamask). Coinbase tried opening its own NFT Marketplace but it hasn’t really been a great success. OpenSea is where it’s at. So this poses a challenge - how could people have the peace of mind that someone takes care of their assets (ignoring the 3rd party risk, as we humans on average always value convenience), while also getting access to all of this cool Web3 stuff?

Coinbase might have a solution - they are releasing a Web3 integration in their app that will essentially allow users to tap into products like Uniswap and OpenSea without the friction of traditional wallets. Should they lose access to the wallet, Coinbase will support them in recovering it, unlike a traditional cold wallet setup. This could really unlock the next level of users getting into DeFi and other Web3 areas. At the same time, Robinhood teased a wallet as well, and Ledger is working on making interactions easier for users as well. Probably nothing.

Mihnea

================

Crypto financing market has remained hot, but is due for a lull period

The crypto VC financing market has tallied $9.2bn in Q1 2022 (per CB Insights), outpacing the previous record set in Q4 2021. April has also seen a record $4.1bn in funding rounds across 244 blockchain / crypto projects.

Private capital war chests are at significantly high levels and are seeking the right opportunities to be deployed. While crypto remains an attractive niche from a tech and risk/reward ratio perspective, the market could enter a quieter period where targets are more thoroughly scrutinized, term sheets take longer to be agreed upon and overall deal timelines get extended. Also, builders need to build, focus on fundamentals and cash-flows while VCs are there to assist. Nonetheless, the market has some tailwinds given start-ups are raising money to extend their runway, traditional VCs and institutions are entering the market (e.g., Bain Capital, EQT Ventures, investment banks), while existing VCs are raising funds for follow-ons or for separate niches (e.g., a16z).

Looking over the recent funding rounds, there have been some interesting ones that highlight a few of the concepts and themes of what is being sought after in order for the industry to advance to the next level.

Coinshift ($15m, Series A) is a treasury management platform that enables DAOs and crypto businesses to manage cash reserves. Built on the Gnosis Safe and having clients such as ConsenSys, Messari, Uniswap or Balancer, the company’s platform allows users like treasury managers and sub-DAO committees to perform payouts and handle treasury balances. Certora ($36m, Series B) provides security analysis tools for smart contracts. By leveraging a system design technology that is used also in the process for chip designs or autonomous system securities, the Company enables smart contract developers to detect mistakes before deploying code post audits. It has 2m+ Solidity lines verified, a blue-chip clientele, $32bn of protected TVL and is expanding from the current roster of EVM-compatible blockchains. Lighthouse Labs ($7m, Seed) is an open metaverse navigation engine. Enables users to search for places, events, creators, experiences, communities, and friends across and within virtual worlds. Talos ($105m, Series B) and Elwood Technologies ($70m, Series A) develop infrastructure for institutional access and have seen strong participation from investment banks. Encode Club ($5m seed round) runs workshops and bootcamps to provide a recruitment pipeline of developers for its partners (Avalanche, Polkadot, Solana, and others). Trained 20,000 developers in total and it states that it has a >50% placement rate vs. industry benchmark of 30%. Its secret sauce is represented by its careful selection process although applications are opened for anybody to enroll.

Razvan

================

The Metaverse Race is getting Richer

With every week that passes, the race for the Metaverse seems more and more like the "who goes to the moon first race" and I can say I can't complain.

We know that companies like Meta, Epic Games, Microsoft, Apple, Nvidia, Bored Ape Yacht Club, Roblox, Decentraland, Unity, Tencent, Amazon, and a lot more are already engaged in the race, but amongst them, there are not so many gaming companies that really know how to "steal" the peoples' attention.

Because right now the feeling of gameplay is left on the secondary plans but I think is the Gameplay that will really make the difference, in the end.

So it was not a surprise to find out that Venture capital firm Andreessen Horowitz (a16z) launched a fund dedicated to Web3 gaming companies. Called Dubbed Games Fund One, the $600 million funds will invest in three areas:

1. Games studios

2. Consumer applications (like Discord, which actually started as an app for gamers)

3. Gaming infrastructure providers

The team from a16z believes that “The coming Metaverse will be built by games companies, using games technologies” and I tend to fully agree with that (and I promise I will write some more on this in the near future) because if something is not keeping you hooked in, you can only play if for the money for so long.

I know it might not make sense, but, despite the fact that I have more than 10 years of experience with programming, and 8 years of building communities, if I were to say what I am at my core, I would say, a Gamer and a Collector. And I truly understand what we, as gamers, think like.

And the $3 billion put by venture funds into the gaming industry for Web3 prove what I just said. And they are going for the big ones that created huge communities of gamers who keep faith for more than a decade for most of them.

Last month, Epic Games, which also game us Unreal Engine 5 which makes the game development so so much easier, raised $2 billion from Sony and Lego to create their own version of the Metaverse. And they already have some experience in the matter with Travis Scott's concert in Fortnite and much more.

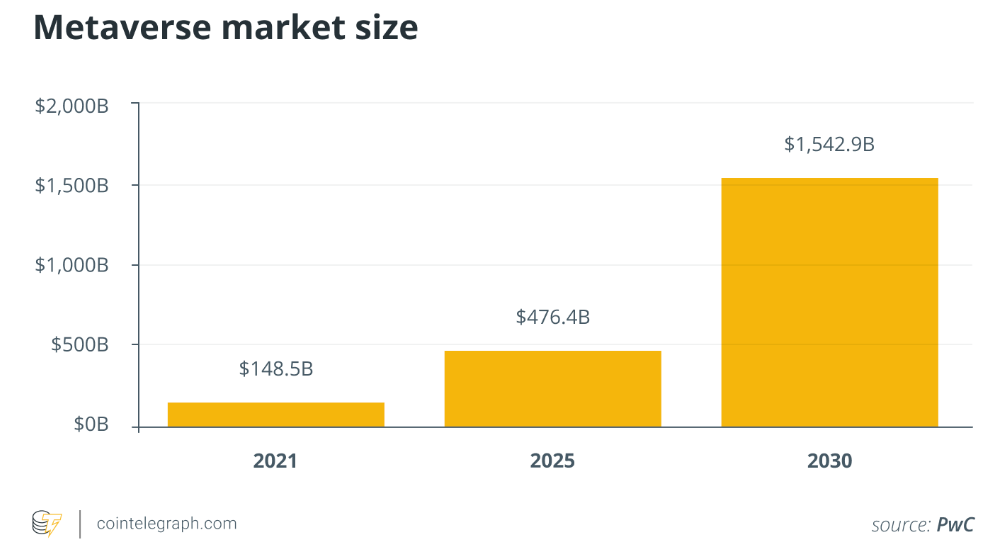

PwC says that by 2030 the Metaverse market size will 10x and I think they are not generous at all, because, If you think about it, worldwide there are more than 3 billion gamers in one form or another, and much more children, young people, middle age tired of working people, older and not being able so much to travel people that can't wait for a place to escape and a world that they can shape as they please.

Ready Player One was just the beginning. I can only hope that they build with interoperability in mind, because, at a certain point, all these Metaverses will have to merge, because if they don't, they will collide instead, making, every time, at least one of them obsolete. Or maybe this is just the plot from Dr. Strang and the Multiverse of madness.

We shall see

Cosmin

================

Blockchain is the solution for cross-border trade and supply chain disruptions

Since the start of the pandemic, supply chains have experienced major disruptions. As an attempt to alleviate some of the ongoing disruptions, actors are paying increased attention to blockchain solutions in order to facilitate compliance, transparency and efficiency in cross-border transactions.

A recent Reuters article summarized the advantages that blockchain technology brings for buyers, manufacturers, lenders, logistic companies and governments, that are offered the chance to securely and quickly share information that can be verified in real-time.

Organizations lose on average 12% of the value expected from procurement contracts due to “hard” leakage such as invoicing errors and incorrect pricing. Blockchain technology makes it possible to integrate all the parties into a single digital environment, significantly speeding up process cycle time and reducing costs. It allows companies to knit together extended business networks while compartmentalizing private information on terms and conditions, and discounts.

Aiming to solve supply chain bottlenecks combining product traceability with inventory management, Big Four accounting firm EY has unveiled its blockchain-based supply chain manager built on the Polygon network. The EY OpsChain Supply Chain Manager, which is now available in a beta version, is the first joint project between EY and Ethereum scaling tool Polygon. Organizations would create tokens to represent assets and inventory, which the OpsChain manager would then track across the supply chain network. Scaling networks like Polygon are designed to lighten the load on base-layer blockchains such as Ethereum, processing transactions on a sidechain to reduce congestion and costs.

By using a combination of Polygon Nightfall’s zero-knowledge proof-based privacy technology and off-chain information management, assets can now be moved across the network with privacy, so that only selected parties can see the full history of those assets. Unlike most enterprise systems, information such as inventory status and location is now retained, even as raw materials and products move across the supply chain and between organizations.

Evelyne

================

For more educational crypto content, check out the links below:

The Stakeborg DAO Talks on YouTube: https://www.youtube.com/playlist?list=PLOrFZZifNn4Nx4nSQL3WS52ALPXgrTSVG

Discord channel: https://discord.com/channels/901898461568442458/903006233584341052

StakeborgDAO Quarterly Reports: https://docs.stakeborgdao.com/reports/dao-quarterly-reports

Stakeborg Academy: https://academy.stakeborg.com/

Thank You👷🏼♂️🧑🏽💻🧱

Thanks for perpetual value stuff !